by Jeffrey Samorano | Aug 6, 2023 | Uncategorized

After all the time you spent finding the ideal home, negotiating back and forth with the seller on the price and terms, both you and the seller may be stunned when the appraisal comes in below the purchase agreement’s price. While low appraisals aren’t as...

by Jeffrey Samorano | Jul 30, 2023 | Uncategorized

Unless you’ll be paying cash for a home or you are applying for a loan backed by the government (such as a USDA or VA loan) or a Fannie Mae or Freddie Mac loan, you’ll need at least 20 percent of the loan amount in cash. This is the down payment, required...

by Jeffrey Samorano | Jul 23, 2023 | Uncategorized

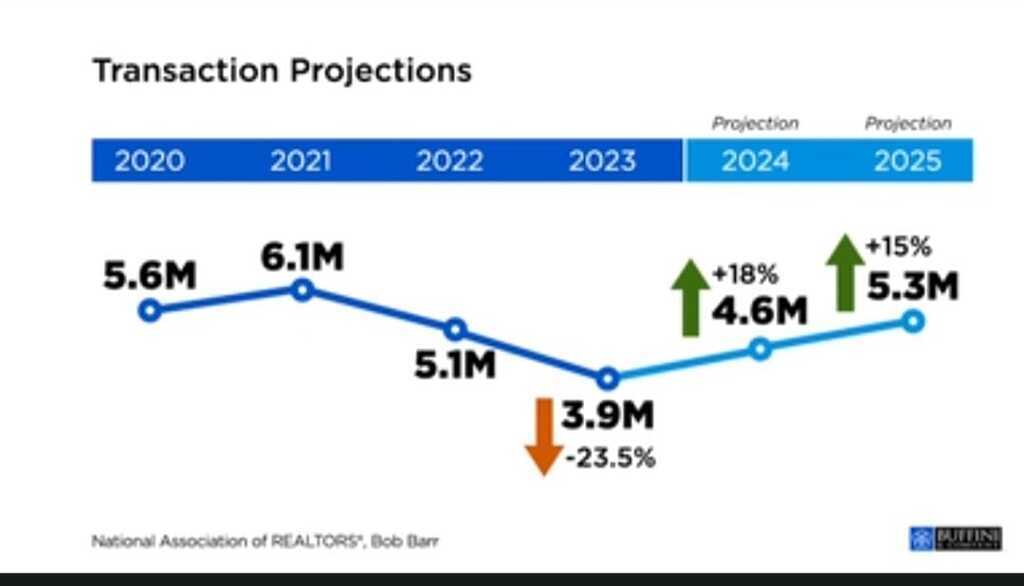

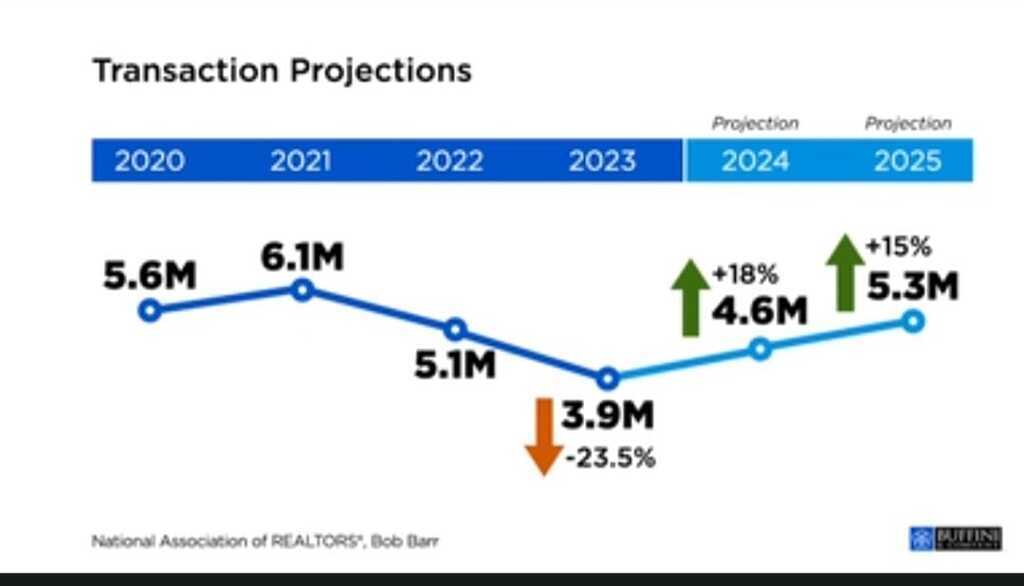

2024 Real Estate Outlook The first quarter of 2024 is predicted to be much of the same as we have experienced in 2023, in the rate arena. Lawrence Yung, Chief Economist has stated there is a distinct possibility that rates will dip to 6.5% in the Spring...

by Jeffrey Samorano | Jul 16, 2023 | Uncategorized

Last time we looked how lenders determine your rate and your credit worthiness based on your credit score. We suggested that you order your credit reports from the “big 3” credit reporting agencies. When you receive your credit reports look for mistakes or...

by Jeffrey Samorano | Jul 9, 2023 | Uncategorized

Embarking on the journey of homeownership is an exciting venture, and with a little knowledge and strategy, you can truly fall in love with your mortgage and home. In this article, we’ll explore two key aspects that can make your homebuying experience achievable...