by Melissa Shaw | Sep 19, 2024 | Uncategorized

Unless you’ll be paying cash for a home or you are applying for a loan backed by the government (such as a USDA or VA loan) or a Fannie Mae or Freddie Mac loan, you’ll need at least 20 percent of the loan amount in cash. This is the down payment, required...

by Melissa Shaw | Sep 19, 2024 | Uncategorized

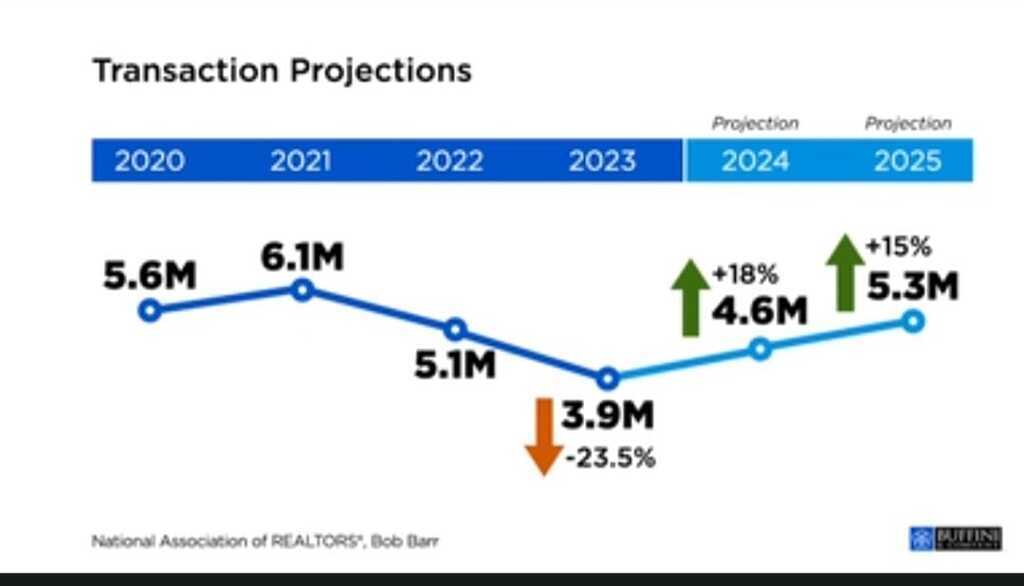

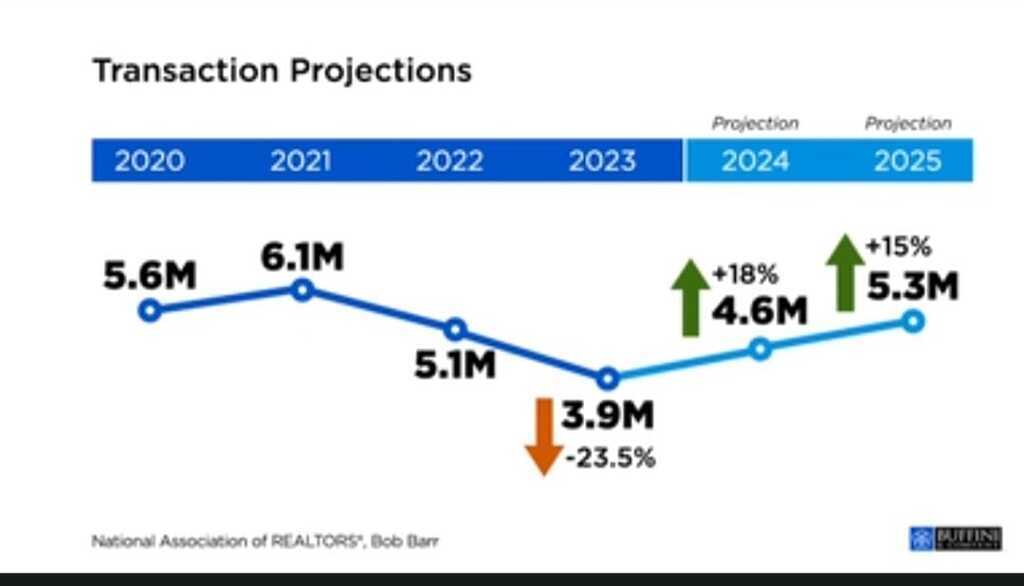

2024 Real Estate Outlook The first quarter of 2024 is predicted to be much of the same as we have experienced in 2023, in the rate arena. Lawrence Yung, Chief Economist has stated there is a distinct possibility that rates will dip to 6.5% in the Spring...

by Melissa Shaw | Sep 19, 2024 | Uncategorized

Last time we looked how lenders determine your rate and your credit worthiness based on your credit score. We suggested that you order your credit reports from the “big 3” credit reporting agencies. When you receive your credit reports look for mistakes or...

by Melissa Shaw | Sep 19, 2024 | Uncategorized

It may not seem like it, but there is a process to buying a home and taking certain steps in the proper order just about guarantees success. Taken out of order – putting the cart before the horse – the steps are inefficient and counterproductive, and the...

by Melissa Shaw | Sep 19, 2024 | Uncategorized

Buying a home is a process that is naturally confusing for the first-timer. A common bewilderment is about how much home can be purchased for the amount of money being loaned. If you’ve ever watched Home & Garden Television’s “Property...